Adani Ports shares rise nearly 4% as Colombo terminal operations commence

April 8, 2025 09:56 am

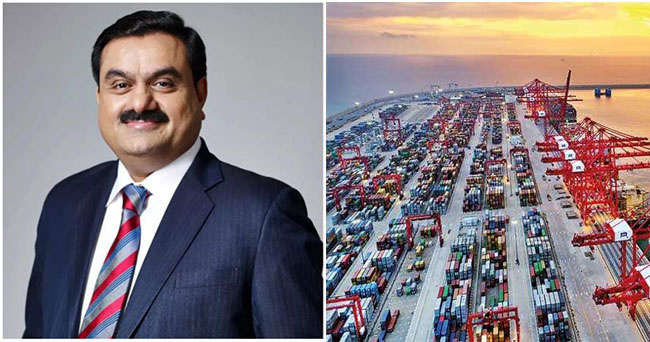

Adani Ports and Special Economic Zone (APSEZ) shares surged 3.6% to their intraday high of Rs 1,151.95 on the BSE on Tuesday after the company officially commenced operations at the Colombo West International Terminal (CWIT), a project that began construction in 2022.

Located at the Port of Colombo, the terminal is developed under a public-private partnership involving Adani Ports, Sri Lanka’s John Keells Holdings PLC, and the Sri Lanka Ports Authority.

The CWIT project represents an $800 million investment and features a 1,400-metre quay length and a depth of 20 metres, enabling it to handle approximately 3.2 million Twenty-foot Equivalent Units (TEUs) annually.

Notably, CWIT is the first fully automated deep-water terminal in Colombo. It is designed to enhance cargo handling efficiency and improve vessel turnaround times, further solidifying the port’s role as a key transshipment hub in South Asia.

Gautam Adani, Chairman of the Adani Group, called the commencement of operations a momentous milestone in regional cooperation between India and Sri Lanka. “This terminal not only represents the future of trade in the Indian Ocean but also places Sri Lanka firmly on the global maritime map,” he said.

Krishan Balendra, Chairperson of the John Keells Group, highlighted the project’s strategic importance for Sri Lanka’s maritime ambitions.

“We are proud to see the progress in the development of the West Container Terminal, a project that strengthens Sri Lanka’s position as a regional maritime hub,” he said. “Together with the Sri Lanka Ports Authority and the Adani Group, we will elevate Colombo’s status as a leading transshipment hub. We are confident that the project will enhance global trade and connectivity in the region.”

Adani Ports share price target

According to Trendlyne data, the average target price for the stock is Rs 1,541, implying a potential upside of 39% from current levels. The consensus recommendation from 15 analysts is a ‘Strong Buy’.

Adani Ports share price performance

On Monday, Adani Ports shares closed at Rs 1,111.5 on the BSE, down 3.23%, while the benchmark Sensex declined 2.95%. The stock has fallen 9% year-to-date and 19% over the past year. The company’s market capitalisation stands at Rs 2.4 lakh crore.

Source: Economic Times

--Agencies