Budget 2019: Liquor and cigarette prices to go up

March 5, 2019 05:32 pm

The Government of Sri Lanka today announced the revision of excise duty on cigarettes and liquor under its budget proposal, which would lead to an increase in prices.

Delivering the 2019 Budget Speech in Parliament, Finance Minister Mangala Samaraweera announced a revision of Excise duty on Cigarettes effective from 6th March 2019 and introduction of Nation Building Tax on manufacturer of Cigarettes effective from 1st June 2019.

Accordingly, Excise duty on Cigarettes, which are more than 60 mm, will be increased by 12%, resulting in an increase of Rs. 5 per stick on average.

Excise duty on cigarettes will now be based on indexation with a minimum annual duty increase capturing annual inflation and GDP growth. This will ensure revenue protection and control affordability, he said.

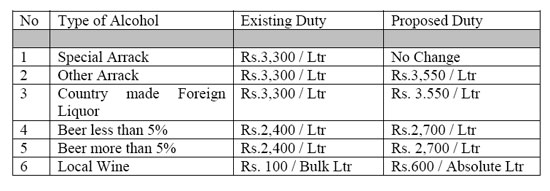

Samaraweera said that the revision of Excise duty on liquor manufactured locally will be based on indexation, effective from 6th March 2019, where the minimum annual duty increase is according to an index capturing annual inflation and GDP growth.

He said excise duty on hard liquor manufactured locally will be increased by 8% and malt liquor by 12% will be done based on indexation effective from March 06, 2019 where the minimum annual duty increase is according to an index capturing annual inflation and income growth (GDP change).

However, the Excise duty on Special Arrack will remain unchanged, the minister said, adding that this is due to the fact that it is mostly consumed by the country’s poor people.

The Finance Minister also announced a revision of Cess duty on importation of Tendu Leaves (Beedie Leaves) from Rs. 2,500 to Rs. 3,500 per Kg, effective from 6th March 2019.

He said a revision of unit rate based custom import duty on selected goods including fruit drink, liqour and tobacco will be effective from 6th of March 2019.

Custom Duty on Undenatured Ethyl Alcohol will be increased by Rs. 200 to Rs. 1,000 per litre.

The Excise Duty based on the Alcohol volume will be revised as follows:

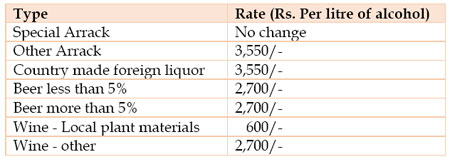

The Excise Duty rate of imported liquor will be revised as follows;

i. Malt Liquor (Beer) - Rs.55/- per bulk litre

ii. Wine - Rs.110/- per bulk litre

iii. Other liquor - Rs.215/- per bulk litre

Excise Duty on cigarettes will be increased by 12% as follows;

i. 60 – 67 mm - Rs.19,500/- per 1000 sticks

ii. 67 – 72 mm - Rs.23,000/- per 1000 sticks

iii. 72 – 84 mm - Rs.37,580/- per 1000 sticks

iv. >84 mm - Rs.42,200/- per 1000 sticks