Taxes and fees on vehicles revised

March 5, 2019 06:40 pm

Several taxes including the import tax, excise tax, and the carbon tax have been revised under the Budget Proposal for the year 2019 presented to the Parliament by Finance Minister Mangala Samaraweera.

Accordingly, the import tax on petrol vehicles under 800 cc has been increased by Rs 150,000 while petrol vehicles under 1000 cc have been by Rs 175,000 cc. The import tax on petrol vehicles under 1300 cc has been proposed to be increased by Rs 500,000.

The import tax on hybrid petrol vehicles too has been increased under the proposed budget. The tax on hybrid petrol vehicles under 800 cc has been increased by Rs 250,000 while the hybrid petrol vehicles under 1500 cc by Rs 500,000.

However, the import tax on electric motor vehicles of 70 kilowatts has been decreased by Rs 175,000.

The import tax on three-wheelers of 200 cc has been increased by Rs 60,000.

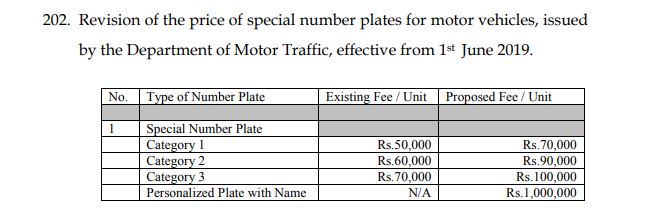

Meanwhile, price revision of special number plates for motor vehicles issued by the Department of Motor Traffic has been proposed under the budget and will be effective from 1st June 2019.

An amount of Rs 48,000 has been allocated for the revision of Excise duty on motor vehicles and implementation of the luxury tax on luxury motor vehicles.

Under the proposed Budget, the Excise Duty on vehicles imported as Chassis fitted with engines will be reduced. Accordingly, the Excise Duty on hearses, single cabs will be revised. The Excise Duty on the hybrid and electric vans will be revised to reflect the energy efficiency benefits. The Excise Duty on Buddy Trucks with cargo carrying capacity less than 2,000 kg will be reduced under the Budget proposal.

Excise Duty revision on passenger vehicles:

Fuel:

Hybrid:

Electric:

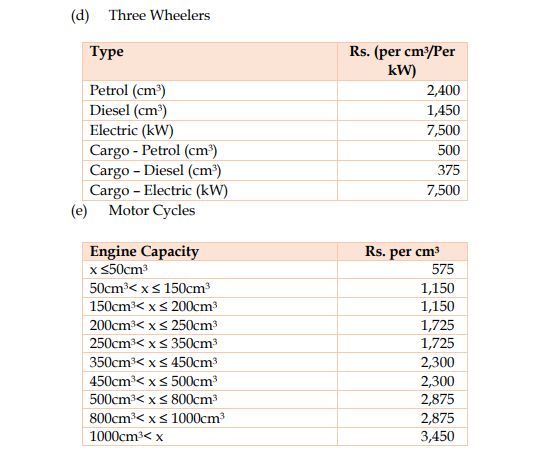

Three-wheelers and Motorcycles:

The maximum carbon tax payable on commercial vehicles, as per the proposed budget, is as follows:

Under Budget 2019, the Customs Import Duty and CESS will be removed on the importation of Go-Kart which is an off-road sports vehicle and Go-Kart Tyres to facilitate promotion of international sports tourism.

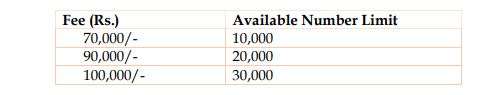

The fee for the reservation of a vehicle registration number in advance from the current registration number will be revised as follows:

Additionally, a lifetime personal vehicle registration numbers will be issued on a fee of Rs 1 million.

Three-wheelers will be supported through a concessionary loan “Mini Taxi-Electric Three Wheeler” under “Enterprise Sri Lanka” Loan Scheme to upgrade into electric three-wheelers and small cars that will be more environmentally friendly, safer and more comfortable. The government will bear 75% of the interest rate and the existing three-wheeler should be disposed of. The maximum loan amount is Rs 2,000,000 with an interest rate of 13.86% repayable by 5 years.

The revision of Excise duty and implementation of the luxury tax on motor vehicles will be effective from 6th March 2019 while the revision of the excise duty will have a minimal impact on smaller personal vehicles. In addition, the 200% cash margin requirements on motor vehicle imports will be removed in the near future, added the Minister.